PM Vishwakarma Scheme: Unlock the potential of the workforce with the PM Vishwakarma Scheme. Discover how this transformative initiative is reshaping opportunities for skilled professionals.

In a dynamic world where skills are the currency of progress, the PM Vishwakarma Scheme emerges as a beacon of empowerment. This comprehensive article delves into the intricacies of the scheme, exploring its impact, benefits, and the transformative journey it offers to individuals seeking to carve a niche in the professional landscape.

Contents

PM Vishwakarma Scheme

PM Vishwakarma Scheme: The Ministry of Micro, Small, and Medium Enterprises launched PM Vishwakarma, a Central Sector Scheme, to offer comprehensive and end-to-end support to artisans and craftspeople. This support includes access to collateral-free credit, skill training, modern tools, incentives for digital transactions, and assistance with market linkage. The program will be put into effect for five years at first, ending in 2027–2028.

Embarking on the journey of skill development, the PM Vishwakarma Scheme stands as a robust initiative, fostering a culture of continuous learning. It addresses the ever-evolving demands of industries, ensuring a skilled and agile workforce ready to tackle the challenges of the future.

Objectives:-

- To make it possible for artists and craftspeople to be recognized as Vishwakarma, entitling them to all of the Scheme’s benefits.

- To offer skill upgrading so they can improve their abilities and to give them access to relevant and appropriate training options.

- To accommodate more advanced, contemporary tools in order to improve their functionality, output, and product quality.

- To make easy credit available to the targeted recipients without requiring collateral and to lower credit costs by offering interest subsidy.

- To incentivize digital transactions in order to promote this Vishwakarma’s digital empowerment.

- To give them a platform for market connections and brand development in order to enable them to take advantage of fresh growth prospects.

Implementing Agency:-

- The following Ministries/Departments collaboratively implement the plan

- Micro, Small, and Medium-Sized Enterprises Ministry (MoMSME).

- Entrepreneurship and Skill Development Ministry (MSDE).

- Ministry of Finance (MoF), Department of Financial Services (DFS).

PM Vishwakarma Scheme Benefits

PM Vishwakarma Scheme: The PM Vishwakarma Scheme is a visionary initiative by the Government of India aimed at uplifting skilled workers across the nation. Named after the Hindu deity Vishwakarma, the divine architect and craftsman, the scheme reflects the government’s commitment to recognizing and supporting the invaluable contributions of skilled workers to the nation’s development.

1 – Skill Certification:

The primary objective of the PM Vishwakarma Scheme is to enhance the skills of workers in various sectors, including construction, manufacturing, and allied industries. This will be achieved through comprehensive training programs and workshops.

- Verification of skills and five to seven days (40 hours) of basic training

- Interested parties may also sign up for Advanced Training, which lasts for 15 days or 120 hours.

- Acknowledgment as Vishwakarma via ID card and certificate

2 – Financial Incentives:

The scheme aims to provide financial incentives to skilled workers, acknowledging their expertise and encouraging them to continually upgrade their skills. This includes scholarships for vocational training, toolkits, and subsidies for advanced training programs.

- Daily Training Stipend: ₹ 500

- Toolkit Bonus: ₹15,000 award

- Collateral-free Business Development Loans: ₹ 2,00,000 (Repayment Period for Second Tranche: 18 months) & ₹ 1,00,000 (First Tranche: 18 months)

- Concessional Rate of Interest: 5% will be deducted from the beneficiary, with MoMSME covering the remaining 8% of the interest subsidy.

- Fees for Credit Guarantees will be covered by GoI

- ₹ 1 for each transaction, with a monthly cap of 100 transactions.

3 – Marketing Support:

The National Committee for Marketing (NCM) will offer services like as quality certification, branding and promotion, e-commerce integration, trade fair advertising, public relations, and other marketing activities.

PM Vishwakarma Scheme Eligibility

PM Vishwakarma Scheme: The scheme is designed to be inclusive, encompassing a wide range of skilled workers. Eligibility criteria may include:

- The applicant should be an artisan or craftsperson who works with their hands and tools.

- The applicant should work independently in an unorganized sector.

- The applicant must be involved in one of the 18 family-based traditional trades listed in the scheme.

- The candidate must be at least 18 years old when registering for the plan.

- The applicant must be active in the relevant trade on the day of registration.

- In the previous five years, the applicant should not have taken out loans under similar credit-based programs of the Central or State Governments for self-employment/business development, such as PMEGP, PM SVANidhi, or Mudra.

- Registration and benefits under the Scheme will be limited to one member of the family.

Exclusions

- Government employees and their families are not eligible.

PM Vishwakarma Yojana Online Apply

PM Vishwakarma Scheme: Prospective beneficiaries can apply for the PM Vishwakarma Yojana through an online portal or designated centers. The application process involves submitting personal details, educational qualifications, and a statement of purpose outlining the individual’s career goals and how the scheme will benefit them.

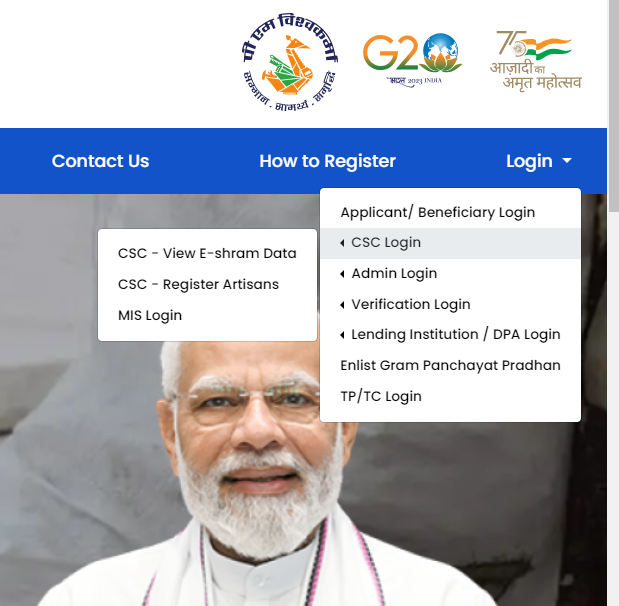

Registration Through PM Vishwakarma CSC Login

- Those who are qualified must enroll themselves through the closest Community Service Center (CSC) in their area.

- The person who wants to get help can apply on their own or with the help of the CSCs through Enumerators or Village Level Entrepreneurs (VLEs).

Registration:

Step 1: To begin, go to the official website for “PM Vishwakarma” and click “Login” in the upper right area. Click on “CSC – Register Artisans” next.

You’ll be taken to where you sign up.

Step 2: Answer the set of questions with “Yes” or “No” on the “Registration Now” page, then hit “Continue.” On the “Aadhaar Verification” page, enter the six-digit OTP that you got on the phone number linked to your Aadhaar. Then click “Continue.” Enter both your Aadhaar number and the mobile number linked to your Aadhaar on the next page. Then click “Continue.”

Application:

Step 1: Go to the CSC closest to you and finish the Biometric Verification Process.

Step 2: The second step is to fill out the online application form with all the necessary information and click “Submit.” Write down the “Application Number” on the next screen for later use. “Done” it.

Verification:

Stage 1: Making sure the person is eligible at the Gram Panchayat or ULB level.

Stage 2: The District Implementation Committee looks over the applications and makes suggestions.

Stage 3: Once the Screening Committee is sure that the beneficiaries are eligible, it will give its final permission for registration.

Benefit Disbursal: The artists and craftspeople will officially register under this Scheme as Vishwakarmas after passing a three-step verification process. They will get a PM Vishwakarma ID card, a digital ID, and a digital certificate. The applicants will be able to get all the benefits of the Scheme because the license will prove that they are Vishwakarma.

PM Vishwakarma Scheme Required Documents

However, in the context of general schemes or programs, the required documents often include:

- Proof of Identity:

- Aadhar Card

- Voter ID

- Passport

- Driving License

- Proof of Residence:

- Aadhar Card

- Voter ID

- Utility bills (electricity, water, gas)

- Ration Card

- Educational Certificates:

- Depending on the nature of the scheme, you might need to provide your educational certificates or diplomas.

- Bank Account Details:

- You may need to provide your bank account details for direct benefit transfers.

Note: 1 In case of a beneficiary not having a ration card, they would be required to produce Aadhaar cards of all family members.

Note: 2. If the beneficiary doesn’t already have a bank account, they will need to open one first, and the CSC will help them do that.

Frequently Asked Questions?

Q. What is Pradhan Mantri Vishwakarma Scheme?

A. The Ministry of Micro, Small, and Medium Enterprises started the PM Vishwakarma scheme as a way to help artisans and craftspeople in all areas. It gives them access to collateral-free loans, training in new skills, modern tools, incentives for doing business online, and help connecting them with markets.

Q. Which category of trades are covered in the scheme?

A. We have jobs for a carpenter (Suthar), an armorer, a blacksmith (Lohar), a locksmith, a goldsmith (Sunar), a potter (Kumhaar), a sculptor (Moortikar) or stone carver or stone breaker, a cobbler (Charmkar) or shoemaker or footwear artist, a mason (Raajmistri), a basket maker or basket waver, a barber (Naai), a garland maker (Malakaar), a washerman (Dhobi), a tailor (Darzi), and someone who makes fishing nets.

Q. What are the key components of PM Vishwakarma Scheme?

A. The most important parts of the PM Vishwakarma Scheme are: 1. Honor: PM Vishwakarma Certificate and ID Card 2. Improvement of Skills 3. Bonus for Toolkit 4. Credit Support 5. Incentive for Digital Transactions 6. Marketing Support

Q. How to avail benefits under the Scheme?

A. Anyone interested in participating in the Scheme may register on the www.pmvishwakarma.gov.in portal.

Q. Which documents are required to be provided during registration on PM Vishwakarma portal?

A. Required for registration are Aadhaar, a mobile number, bank account information, and a ration card.

Q. Which lending institutions can provide credit under the Scheme?

A. Lending under this Scheme is permitted to Scheduled Commercial Banks, Regional Rural Banks, Small Finance Banks, Cooperative Banks, Non-Banking Finance Companies, and Micro Finance Institutions.

Q. What is the amount of initial loan under the scheme?

A. For a period of 18 months, the initial “Enterprise Development Loan” with no collateral can be up to Rs 1,00,000.

Q. When will an applicant become eligible for the second tranche of a loan under the PM Vishwakarma scheme if they have already utilized the first tranche of the loan?

A. The second loan tranche, amounting to Rs. 2,000,000, will be accessible to proficient recipients who have adapted digital transactions for their business operations or have completed Advanced Skill Training and maintain a standard loan account.

Q. Do applicant need to give any collateral to avail loan facility under this scheme?

A. The requirement for collateral security is deemed unnecessary.

Q. What is the rate and amount of interest subvention in the scheme?

A. A fixed concessional rate of interest of 5% will be levied on loan beneficiaries. The interest subvention granted to banks in advance by the Government of India will amount to 8%.

Conclusion

The PM Vishwakarma Scheme stands as a testament to the government’s commitment to harnessing the potential of skilled workers for national development. By focusing on skill enhancement, financial empowerment, and entrepreneurship, the scheme not only benefits individuals but also contributes significantly to the socio-economic growth of the country.

As the scheme progresses, its impact is expected to resonate across various sectors, creating a skilled and empowered workforce ready to meet the challenges of the 21st century.

Sources And References

PM Vishwakarma Yojana Official Website

PM Vishwakarma Yojana FAQ

8 thoughts on “PM Vishwakarma Scheme @pmvishwakarma.gov.in”