Pradhan Mantri Fasal Bima Yojna: Pradhan Mantri Fasal Bima Yojana (PMFBY) is a major agricultural insurance scheme launched by the Government of India in 2016 to provide comprehensive crop insurance to farmers. Its purpose is to protect them from crop loss or damage due to natural disasters, pests and diseases.

The main objective of this program is to stabilize farmers’ incomes by ensuring that funds are not lost due to unexpected agricultural crises, thereby promoting sustainable agriculture.

Pradhan Mantri Fasal Bima Yojna Full Details

Pradhan Mantri Fasal Bima Yojna: Pradhan Mantri Fasal Bima Yojana (PMFBY) is an ambitious agricultural insurance scheme launched by the Government of India on 13 January 2016 under the leadership of Prime Minister Narendra Modi. This plan is designed to provide financial security to farmers in the event of crop failure due to various disasters, pests or diseases.

With the main objective of securing farmers’ income and encouraging them to farm without the constant fear of loss of income, PMFBY has emerged as one of the government’s major interventions in the sector. agriculture of India. This insurance scheme has replaced the previous crop insurance schemes, including the National Agricultural Insurance Scheme (NAIS) and the Modified National Agricultural Insurance Scheme (MNAIS), which had many shortcomings in terms of coverage, rates money and claim settlement..

Details:

Pradhan Mantri Fasal Bima Yojna: PMFBY works on one country, one product, one currency. Provide insurance coverage and financial support to farmers in case of failure of any of the declared crops due to natural disasters, pests and diseases.

- Ensuring farmers’ income to sustain their farming.

- Encourage farmers to adopt new and innovative farming methods.

- To ensure the flow of credit to the agricultural sector.

Implementation Agency

Pradhan Mantri Fasal Bima Yojna: The scheme will be implemented through a multi-agency framework of selected insurance companies under the overall direction and control of the Ministry of Agriculture, Labor and Welfare (DACandFW), Ministry of Agriculture and Farmers Welfare (MoAandFW), Government of India (GOI). ). ) and the relevant government in collaboration with other agencies;

That is, financial institutions like commercial banks, cooperative banks, local rural banks and their governing bodies, government departments like Agriculture, Co-operatives, Horticulture, Statistics, Finance, Information/ Science & Technology, Panchayati Raj etc. Pradhan Mantri Fasal Bima Yojna

Notified Area: Notified Area is the Unit of Insurance decided by the State Govt. for notifying a Crop during a season.

Risks to be covered

- Yield Losses: Comprehensive risk insurance is provided to cover yield losses due to non-preventable risks, such as

- Natural Fire and Lightning

- Storms, Hailstorms, Cyclones, Typhoons, Tempest, Hurricanes, Tornados, etc.

- Flood, Inundation, and Landslide

- Drought, Dry spells

- Pests/ Diseases etc.

- Prevented Sowing (on notified area basis):-In cases where most of the insured farmers are prohibited in the notified area and intend to plant/plant and the expenses incurred for this purpose are prohibited from planting/planting the insured crop due to adverse weather conditions, they are subject to maximum regulation. payment. 25% of the sum insured.

- Post-Harvest Losses (individual farm basis): Covers up to 14 days from harvest for produce held under “cut and spread” conditions for post-harvest field drying, storm/storm events, rain is available all over the country.

- Localized Calamities (individual farm basis): Loss/damage due to occurrence of identified regional hazards such as hail storms, landslides and floods affecting isolated farms in the declared area.

Benefits:

Pradhan Mantri Fasal Bima Yojna: The benefits of this scheme are mentioned as under:

- Comprehensive insurance coverage for Kharif and Rabi crops.

- Add on the coverage available for specific circumstances.

- Optional for farmers, both loanee and non-loanee.

- Stability in the income of farmers so that they can continue farming.

Premium Rate

| S. No. | Season | Crops | Maximum Insurance charges payable by the farmer (% of Sum Insured) |

|---|---|---|---|

| 1 | Kharif | Food & Oilseeds crops (all cereals, millets, & oilseeds, pulses) | 2.0% of SI or Actuarial rate, whichever is less |

| 2 | Rabi | Food & Oilseeds crops (all cereals, millets, & oilseeds, pulses) | 1.5% of SI or Actuarial rate, whichever is less |

| 3 | Kharif & Rabi | Annual Commercial / Annual Horticultural crops | 5% of SI or Actuarial rate, whichever is less |

The difference between the cash rate and the insurance premium paid by the farmers is called the common cash rate and is shared equally between the Center and the states.

Eligibility

- The farmer must reside in the insured agricultural land or share.

- Farmers must have a valid or valid land ownership certificate or a valid land lease agreement.

- The farmer must apply for the insurance within the specified period, usually 2 weeks after the beginning of the planting season.

- They may not have received compensation for the loss of a similar product from another source.

- The farmer must have a valid bank account and present bank account information and valid identification at the time of registration

- All farmers who cultivate during the season in the reading area. The effects are insured for the relevant product.

Exclusions

Exclusion: Problems and losses arising from the following perils are excluded: –

War and family, nuclear disease, riots, vandalism, theft, enmity , animal grazing and damage to livestock and wildlife. of damage After harvesting, the harvested fruits are collected and stored in a place before threshing, other hazards that can be prevented.

Application Process

Online

How to Apply?

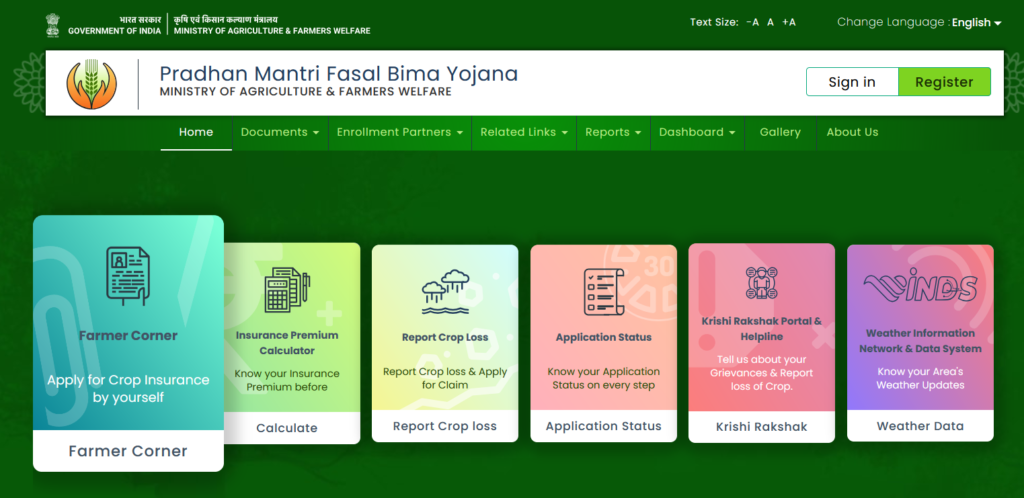

- Applicant farmers have to visit the official portal.

- Click on Farmer Corner

- If the candidates do not have an account in the portal, click on the guest account. Enter all the details correctly and click submit. An account is created.

- Fill out the form in the insurance scheme and provide the required details

How to Claim?

- In the event of a loss, farmers must contact the insurance company within a set period, usually up to 72 hours after the damage occurs.

- List the relevant person/company information in the portal and click on “Report product loss” or download the app and report product loss.

- The claim should be accompanied by supporting documents such as a photograph of the damaged product and a report from the Village Level Committee (VLC) and the Agriculture Department.

Documents Required

- Bank account number.

- Aadhaar card.

- Khasra number of land.

- Agreement photocopy.

- Ration card.

- Voter ID.

- Driving license.

- Passport-size photograph of the farmer.

Frequently Asked Questions

Q. I am not the owner of land, can I get crop insurance under this scheme?

A. Yes, if you are a tenant on someone else’s farm, you are eligible to get your crop insured under this scheme.

Q. How can I calculate my insurance premium in NCIP?

A. There is an insurance premium calculator on https://pmfby.gov.in/ where you can fill in the basic details and calculate the premium.

Q. Am I eligible for a claim if only my land is affected by a calamity?

A. Yes, you need to inform through the crop insurance app or toll free number, insurance company, the bank or the concerned official within 72 hours of the incident, you’ll be eligible for the loss assessment and claim.

Q. Which documents do I need to apply for the scheme?

A. Khasra, khatauni, bank account details, and Aadhaar are needed along with the declaration about the crop you are planning to sow.

Q. Can I apply for the scheme online myself?

A. Yes, create your farmer’s login account in the NCIP https://pmfby.gov.in/ and select “Farmer Corner” on the portal. There you can apply for the scheme after logging in.

Q. How do I check the status of my application?

A. In the NCIP https://pmfby.gov.in/ select “Application Status”, fill in the receipt number as prompted and you’ll be able to see the status of your application.

Q. When should I report the crop loss?

A. You should report the crop loss through the crop insurance app, or toll-free number, or directly to the concerned authority within 72 hours of the calamity.

Q. How can I report crop loss?

A. You can report the crop loss through the NCIP https://pmfby.gov.in/ by selecting “Report Crop Loss” or through Mobile Application, the centralized Toll-Free Number, directly to the Insurance Company through its dedicated toll-free number or through the concerned bank, local agriculture department Government/district officials.

Q. How can I claim the insurance?

A. The farmer should intimate about the crop loss within 72 hours of the calamity through Mobile Application, the centralized Toll-Free Number, directly to the Insurance Company through its dedicated toll-free number or through the concerned bank, local agriculture department Government/district officials. However, the first mode of intimation should be either Crop Insurance App or the centralised Toll-Free Number. After that duly filled intimation / application of crop insurance app along with all relevant documents is necessary for initiation of loss assessment and payment of claims.

Q. How will I know if I have received the claim?

A. You’ll be intimated by SMS about the benefit transfer on your registered mobile number.

Conclusion

Pradhan Mantri Fasal Bima Yojna: The Pradhan Mantri Fasal Bima Yojana represents an important step in protecting Indian farmers from agricultural crises. The program promotes financial stability, encourages innovation and promotes sustainable agriculture by providing comprehensive and affordable crop insurance. Pradhan Mantri Fasal Bima Yojna

But for the program to achieve its full potential, the challenges of delaying claims settlement, improving farmers’ awareness, and ensuring that insurance companies have funding need to be addressed. With continuous innovations and increased use of technology, Pradhan Mantri Fasal Bima Yojna holds great promise for securing the future of the Indian agriculture sector.

1 thought on “Pradhan Mantri Fasal Bima Yojna Full Details @https://pmfby.gov.in”